Navigating the intricacies of insurance in Florida can feel like a complex puzzle, especially when it comes to understanding the unique role of Personal Injury Protection (PIP) insurance. Whether you’re cruising the sunny streets of Melbourne or commuting through the busy highways of Orlando, PIP is an essential component of your insurance suite. But the question persists: do you need PIP if you already have health insurance?

Personal Injury Protection, commonly referred to as PIP, is mandatory for all drivers in the Sunshine State. PIP ensures that if you’re injured in a car accident, immediate medical needs are covered regardless of who’s at fault. This no-fault insurance provides a vital safety net that complements your health coverage.

Florida law requires drivers to carry a minimum of $10,000 in PIP insurance. This mandate was developed to ensure consumers receive prompt medical care without the customary delay of establishing fault, thereby safeguarding both drivers and healthcare providers.

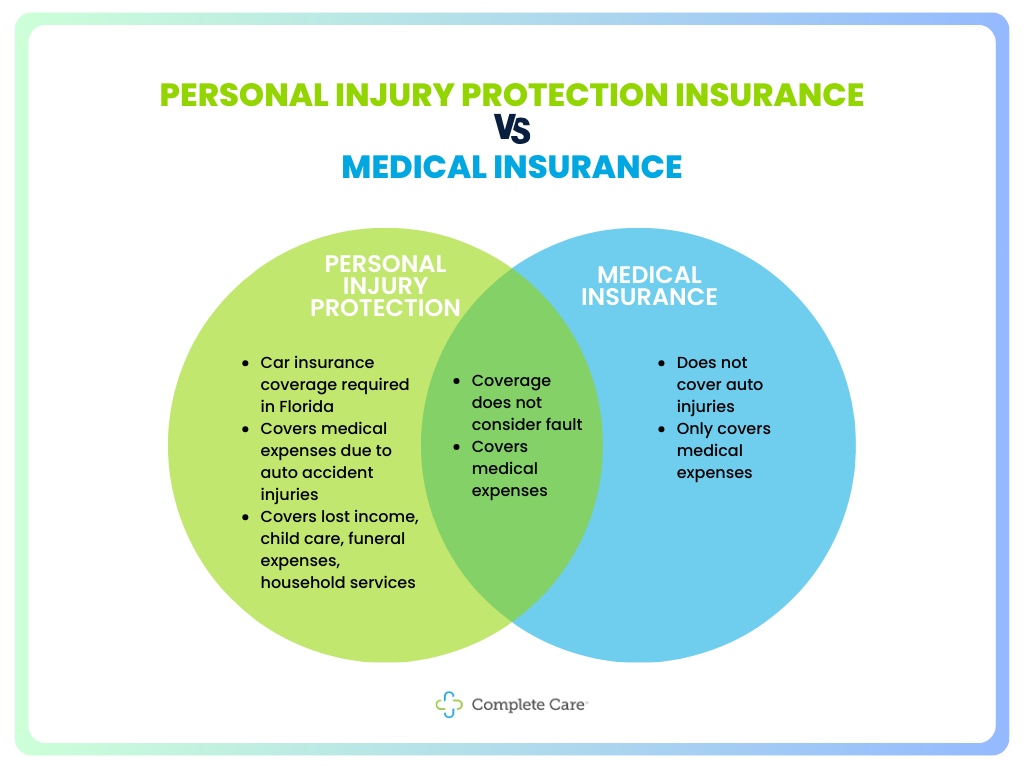

Unlike traditional health insurance, PIP is designed specifically for car accident-related injuries. Here’s what sets PIP apart:

Despite having overlaps with health insurance, the immediate accessibility to funds and broad coverage during auto accidents make PIP an essential component of your insurance portfolio.

However, PIP has its limitations—it doesn’t cover 100% of lost wages or medical bills, and it doesn’t extend to property damage or pain and suffering.

Whether you’re at fault or a victim in a no-fault accident, PIP provides coverage. It’s designed to ensure that, in the immediate aftermath of a collision, financial concerns don’t prevent you from seeking medical care.

After an accident, it’s crucial to seek medical attention immediately—not solely for health reasons but also because delaying can affect your insurance benefits. Document everything meticulously, as this will be foundational if and when filing a PIP claim.

The claim-making process calls for adherence to precise steps and timing. Florida law stipulates that treatments are generally required to be sought within 14 days post-accident to qualify for PIP benefits.

For Florida drivers, having both PIP insurance and health coverage is a critical aspect of their insurance portfolio. With PIP’s unique advantages, it’s clear that even with comprehensive health insurance, the protection it offers is invaluable.

When it comes to PIP insurance guidelines in Florida, know that your safety net is wider with PIP on your side. You’ve taken the right first step to understanding how PIP insurance protects you and rest assured, as a Florida driver, you’re better shielded as you travel down the road.

For personalized guidance, it’s recommended to consult with insurance professionals who can provide tailored advice based on your individual circumstances.

Understanding how PIP insurance differs from health insurance can be overwhelming after a car accident-but you don’t have to figure it out alone. At Complete Care, our team is open to answer your questions, help you understand your benefits, and guide you through the post-accident process with confidence.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser.